If you see what you are looking for, go ahead and click the name of your bank or brokerage. After you type a few characters Quicken displays a list of possible matches. If your bank or brokerage is not listed on the screen, start typing its name.

If your bank or brokerage is listed on the screen, click it. You can also choose to Add Another Account.

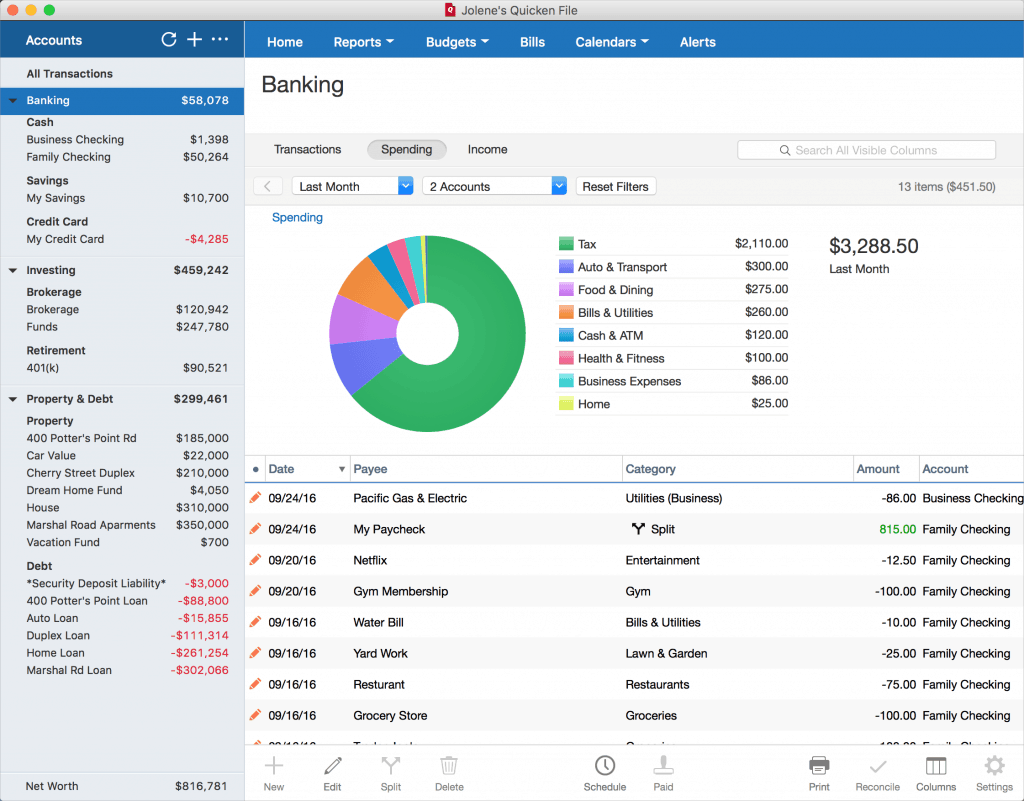

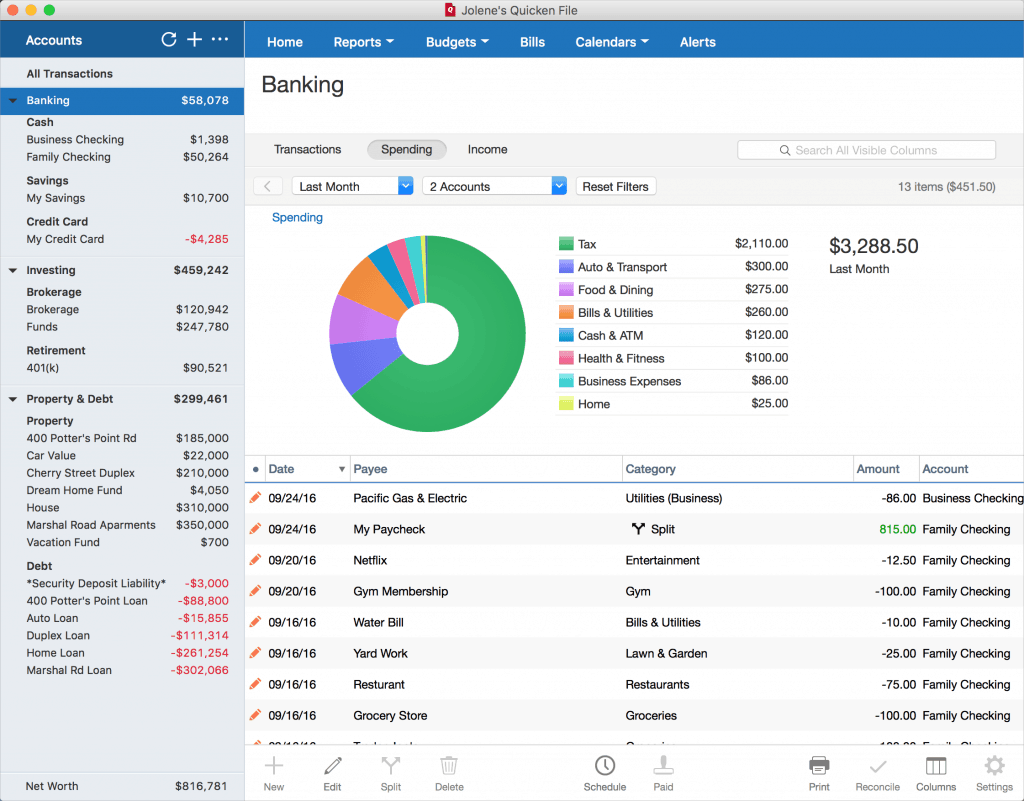

Enter your Statement ending date (The date you want to start tracking from) and your Statement ending balance (how much was in your account that day). Depending on your version of Quicken, you may also have options for selecting how your account is used. Spending accounts include Checking, Savings, and Credit Card. You can also add a new account by selecting Tools → Add Account from the top menu. Select the Add Account icon on the top right of the Account Bar. In most cases, it is preferable to use an online account, but you may choose this for security, control, or because the account is not with an institution Quicken can connect to. It is your responsibility to enter all the information and track your transactions accurately. Offline accounts (sometimes called manual accounts) don't connect to a financial institution. You can choose to either Add Another Account or Finish. You'll see a message letting you know what accounts were added. Action: Select Add to Quicken if you want to add an account.  Used for: Most accounts will be Personal, but depending on your versions you may have the option of Business and Rental. Nickname: Enter any name that helps you easily identify the account. Type: Your options will vary according to the financial institution but Checking and Savings are the standard types. On this screen, you can make any adjustments, then click Next. Quicken will find all the accounts associated with your login. you may be asked for additional information, such as a challenge question or a code that is sent to your email or phone. This is the information you use to sign in to your online account, such as a user name and password. In those cases, see our instructions for adding an offline spending account below.Įnter your account/user information. While Quicken works with over 14,000 financial institutions, there are some financial institutions that may not be available. You can also contact our customer support. If you cannot find your financial institution, go to their website or call them to see if they provide instructions for working with Quicken.

Used for: Most accounts will be Personal, but depending on your versions you may have the option of Business and Rental. Nickname: Enter any name that helps you easily identify the account. Type: Your options will vary according to the financial institution but Checking and Savings are the standard types. On this screen, you can make any adjustments, then click Next. Quicken will find all the accounts associated with your login. you may be asked for additional information, such as a challenge question or a code that is sent to your email or phone. This is the information you use to sign in to your online account, such as a user name and password. In those cases, see our instructions for adding an offline spending account below.Įnter your account/user information. While Quicken works with over 14,000 financial institutions, there are some financial institutions that may not be available. You can also contact our customer support. If you cannot find your financial institution, go to their website or call them to see if they provide instructions for working with Quicken.

0 kommentar(er)

0 kommentar(er)